“As we look not to the things that are seen but to the things that are unseen. For the things that are seen are transient, but the things that are unseen are eternal.”

Motivation

Why write a case against Augur? Well, its pure self-defense at this point. Thanks to their zealous marketing team / dedicated social-media influencers, I can’t even be summoned to Reddit without a salvo of ignorant comments.

I get it, there are people who don’t know the whole story. Probably most of the people working for Augur don’t know the whole story.

So here it is: the case against Augur.

First, Some Background

If you don’t know anything about Augur, there’s really no need for you to continue reading at all.

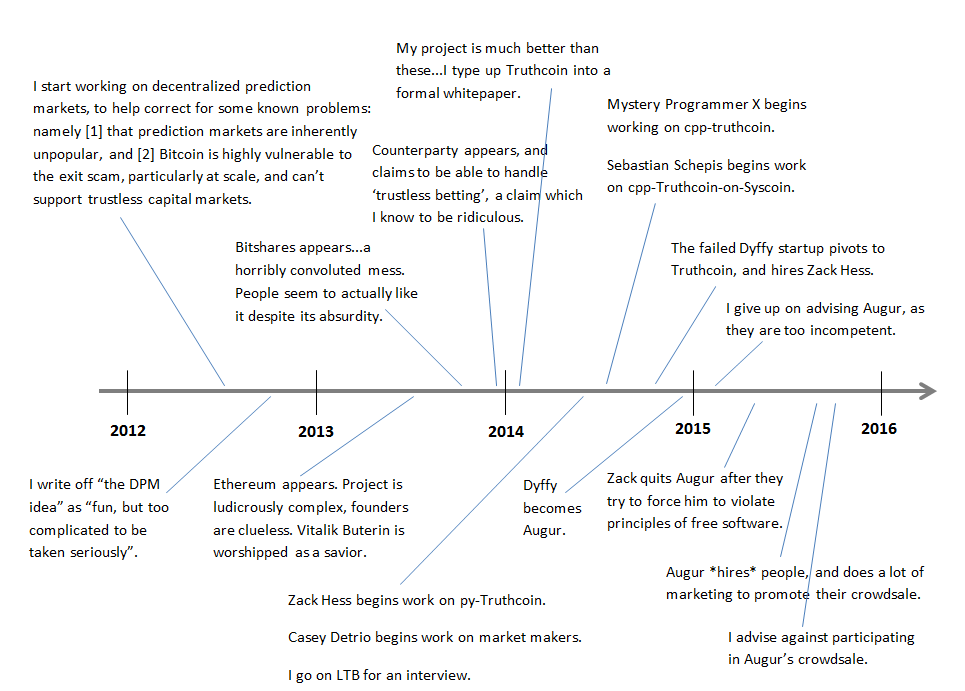

However, if you are interested, here is a (rough) timeline of the key events leading up to this point:

Agenda

This essay will be in three sections:

- Why Augur has no future, and people would be better off with other projects (namely, Roger Ver’s project Hivemind, but to a lesser extent Zack Hess’ Flying Fox and Schebastian’s unfinished work) or with starting from scratch.

- The numerous lies and misrepresentation of the fraudulent Augur leadership team.

- My own personal interpretation perspective on the factors driving Augur’s $5 million dollar crowdsale.

Part One - Augur Has No Future

1. Who am I to criticize Augur, you might ask? Well, I am the creator of Augur!

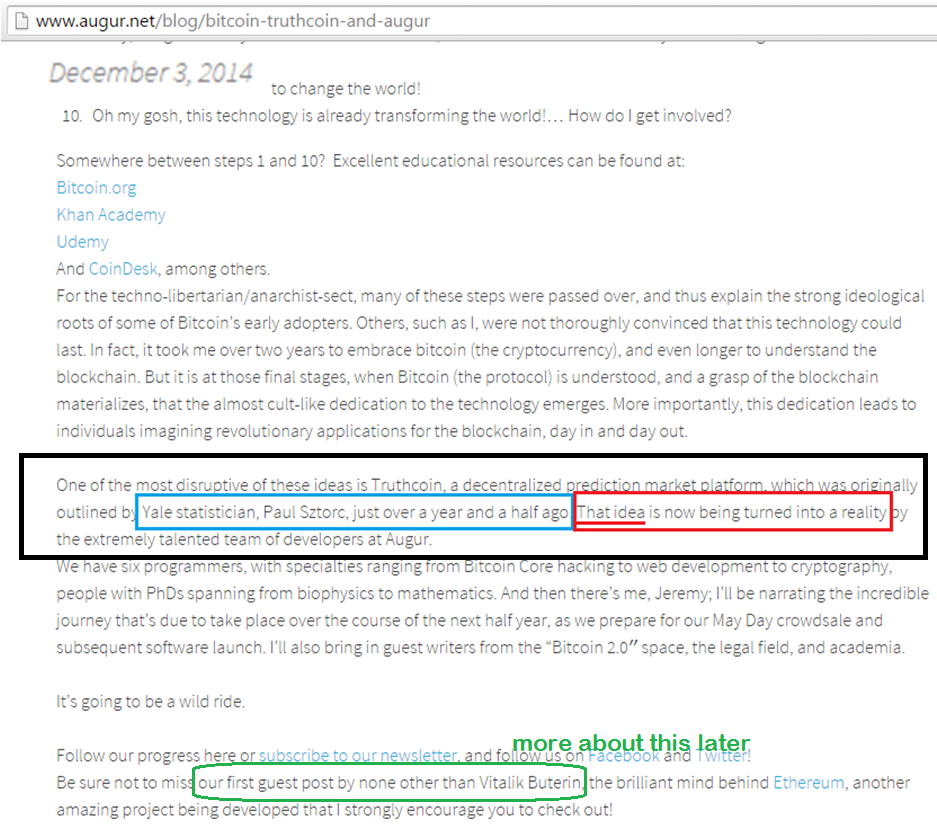

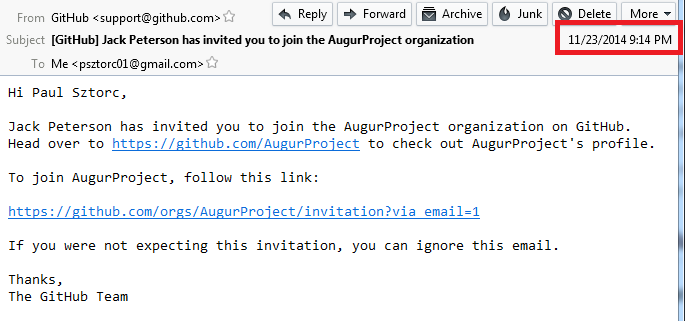

Don’t take my word for it, take it from Augur Marketing Director Jeremy Gardner (with my emphasis added):

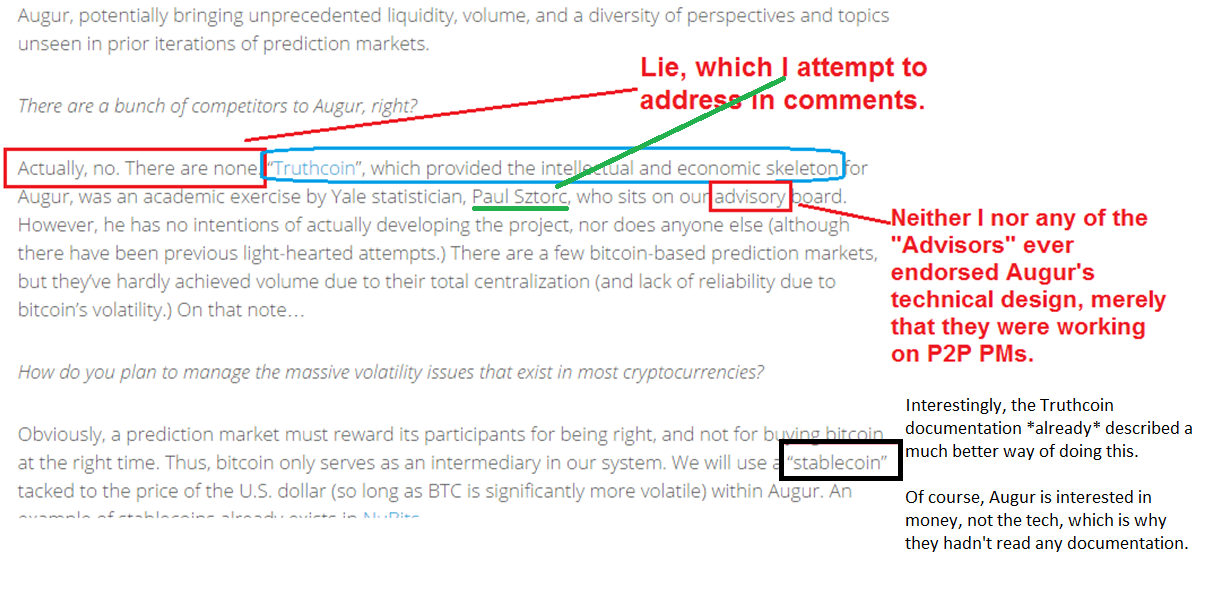

And check out the FAQ article he wrote later:

It’s interesting that that answer was whitewashed, not after I pointed out that it was wrong, but instead, months later, when I announced that I was going to support a much better implementation of the project.

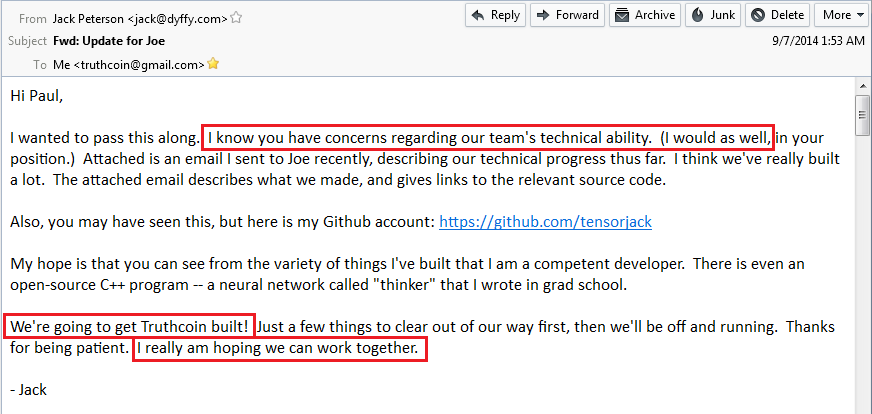

Not only is Augur an attempt at Truthcoin (alongside several other -more promising- attempts such as Flying Fox), but, in fact, when I met Joey Krug and Jack Peterson, they were soon-to-be unemployed, and ecstatic to have “discovered” an amazing idea to pivot to. In order to justify taking Joe Costello’s money, they tried unsuccessfully to hire me for all of 2014.

That video claims that I had no plans to build the software myself.

I hadn’t, but -I soon realized- neither did the Augur team (which is why I refused to join them)! For I had laid out very important design-requirements for Truthcoin, which the Augur team abandoned whenever:

- They did not understand them (more on that later), usually because they hadn’t bothered to ctrl+f the whitepaper.

- Their financial backers, namely Vitalik Buterin, wanted them to.

Of course, Truthcoin was an open proposal, so I “advised” them for free, taking hours out of my day to talk to them about the protocol’s requirements, despite the fact that I was already working full time (and they were being paid to work directly on this).

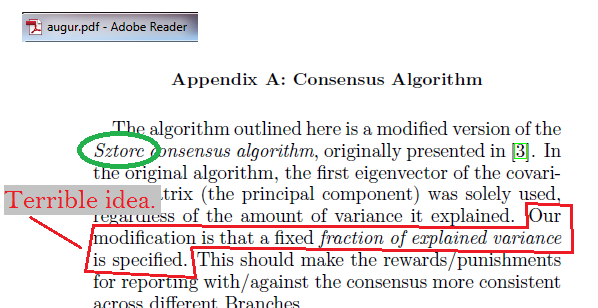

Of course, Augur did make a number of changes to the core Truthcoin idea. The mistakes are too numerous to list, so I’ll just focus on one:

2. Jack’s Misguided RBCR Obsession

RBCR refers to the part of Truthcoin’s core design which exploits scale and cross-referencing to help glean objective truth from a bunch of subjective reports.

On Improvements to Truthcoin

Truthcoin has been improved in the past. Casey Detrio improved TC twice, through hard work and specialization. Andrew Poelstra, after Roger Ver hired him to review the design, made minor improvements in essentially one weekend. Peter Todd (over a single ~3 hour phone conversation) and Zack Hess (over several months) provided a menu of alternatives to various design-choices…most of which I am declining at present, but which I am (of course) certainly considering as the final implementation firms up.

Countless people wrote in, to add some clarity to a specific line item in the Truthcoin whitepaper, for example Riccardo Casatta.

RBCR, however, has never been improved.

A Note on the PhD

Jack Peterson, Augur Head Fraudster, graduated with a PhD awhile back from Some-School-I-had-to-Google in California.

To gloss over some important details, in general getting a PhD is a ton of (hard, underpaid) work, for which you are eventually rewarded with the job of tenured professor.

For those who get a PhD, but instead go on to work in industry, the interpretation is usually that they were unable to get an academic job. That’s a huge generalization, of course (I know a few Statistics PhD’s who very much chose and worked for their multi-million Wall St. salaries), but that’s the basic story.

When I met Jack, he was a 30-something year-old, ungrateful subordinate to a 22-ish year old college dropout. The CEO, not-Jack, asked me for my advice and opinion on the startup (as it was vaugely related to Truthcoin), and I tried to explain to them why their idea wasn’t new, wasn’t good, and had no future.

So, you had to feel bad for this Jack guy. All that analytic training, only to go entirely unused.

Certainly, the CEO complained to me that Jack did not respect him, and wanted to do everything his own way.

Which ordinarily I can respect, but I’m sure it made him particularly vulnerable to The Bitcoin Phantom Flaw Phenomenon.

Which we will now discuss.

The Gift That Keeps on Giving

Augur only deliberately made one change to original Truthcoin (don’t even get me started on the numerous mistakes). This single change actually managed to break the entire incentive structure. I pointed out the flaw, and they (eventually) were forced to admit that their change was a terrible idea, and they changed it back.

Then, believe it or not, they changed that thing again, and broke it a second time. Again, I pointed out the error, and again, (months later) they were ultimately forced to agree that they had again made a mistake.

And then, get this, they actually changed it a third time to something else, which was again broken! These are poorly-researched changes (“mistakes”), put in purely [1] for product differentiation and a better crowdsale and [2] because Jack won’t seek therapy for his inferiority complex.

You see, Jack consistently interprets what I did in Truthcoin (a weighted PCA), the way he was trained to do so, in graduate school (anyone familiar with statistics will notice his from-a-textbook focus on “explained variance”, despite the fact that I use PCA in a completely different way).

RTFM

In short, the problem is that Augur’s improvements always suck, and they have always sucked. What they suck up most, is my free time. They suck because the Augur team is motivated by ego and money, as opposed to a love of the technology.

You -the layperson reading this- can appreciate, I hope, what it is like to work on something, for free, discarding all of the ideas that didn’t work, getting the code right, writing it up, printing that writing out, editing it, publishing it, making sure the publication looked good on the internet, responding to feedback.

And then some people just do something else “because usually it’s done like this” or “people were complaining about {misunderstood feature du jour}”. And you know that the real reason is just because Jack wants to weasel his way into taking some intellectual credit for the idea.

Some of it is almost too painful to explain: Jack is certain that he proposed the LS-LMSR, even though Casey discussed it with me months before I met Jack, he believes that he renamed VoteCoins to Reputation and shortened it to “rep”, even though my original Dec 2nd, 2013 code has “Rep” everywhere, as do all versions of the whitepaper refer to it as “the reputation vector”, he believes that he discovered a “flaw” where the mechanism “stops working when less than 50% of the voters are honest”. Sometimes, I don’t know what to say.

I am sure that Jack is sincere in believing these things, even though they are completely untrue, and I am sorry to have to point it out.

Speaking of sincere-but-ridiculous…

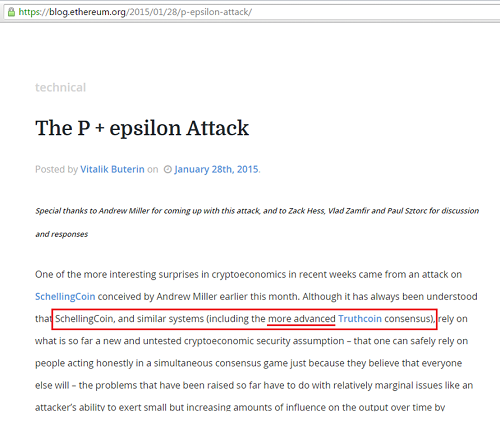

3. Reliance on Ethereum is Foolish

Augur, despite my endless protests, is built on Ethereum.

Ethereum is a running joke among Bitcoin experts. To the clearminded, it’s failure as an “investment” was always a foregone conclusion.

Here are some bullet points in no particular order:

A. Since transitioning from academic experiment to full-blown dishonest scam, Ethereum is laughed at at Bitcoin conferences.

B. For econo-math reasons, Ethereum is incapable of supporting “oracle contracts” (of which Augur is one). tl;dr How can “Rep” have a market cap, if the operations performed by the “Rep”-holders can be perfectly copied, for free? Therefore, market cap (and, crucially, the betting security margin) will be prohibitively low.

C. When Vitalik proposed Ethereum, the technical elite of Bitcoin were so impressed that 0% of them decided to endorse/join the project (compare this to hardware wallets, colored coins, stealth addresses, sidechains, elements project [confidential transactions, tree signatures, RCLTV], lightning network, and my own project).

D. The concept “don’t roll your own crypto” is very old, constantly-reproven, and universally endorsed. Crypto takes a very long time to get right; critical errors were regularly discovered in Bitcoin (which was actually a finished software product when it was published in Jan 2009) and continue to be discovered today. However, Bitcoin at least has consistent rules, and thanks to the Soft Fork the security can at least accumulate over time. With Ethereum, every contract changes the rules completely, and resets the potential chaos (For example, “Contract Z commits to ‘'’If contract X is created, auto-create the opposite of X and overfund it by Q.’’’ which disables contract X.” which leads to symmetry-gridlock).

E. Ethereum is out of money, the software will never reach a stable, usable state.

F. The Ethereum team endorses an even bigger running joke: proof of stake, which is also laughed at and compared to perpetual motion. There are reasons that Bitcoin embraced P2SH and LN, but rejected PoS, GHOST, etc.

G. Today, most people have still not heard of Bitcoin. Most that have, still don’t trust it. Quadruple that problem for Ethereum, as it has an even greater reliance on group(s) of people coordinating to switch to it.

H. Ethereum is strategically trapped: if they fail, the Ether will be worthless, and if they are successful, the project will be forked as a sidechain of Bitcoin (and the Ether will be worthless). They can only survive by maintaining “Goldilocks Success” and by generally being as vague as possible (which explains the overly-ambitious plans, countless buzzwords, endless promotional videos, etc).

Ethereum has only one use-case: quickly finding the most gullible “investors” people…those people who own Bitcoin but can’t think quickly enough to sort the signal from the noise.

4. The Whole Point of Truthcoin was that it would NOT be a Tech Startup

What I designed was, of course, a protocol…not a business.

Augur, however, is a tech startup.

In other words, Augur is the “permissioned ledger” to Truthcoin’s Bitcoin. Hopefully it should be clear by now that blockchains are an inefficient database, useful only to get something unpopular done.

Contradictions between startups and protocols:

A. Startups can be sued or fined by the government in which they reside, protocols cannot reside anywhere and cannot be sued or controlled.

B. For security reasons, all Bitcoin software must be open source. However, open source software can be used for free, by definition. The startup must get revenues from non-software sources…but this discourages them from working on improving the software! (Instead, they’d like to make it as confusing to install/use/work-on as possible).

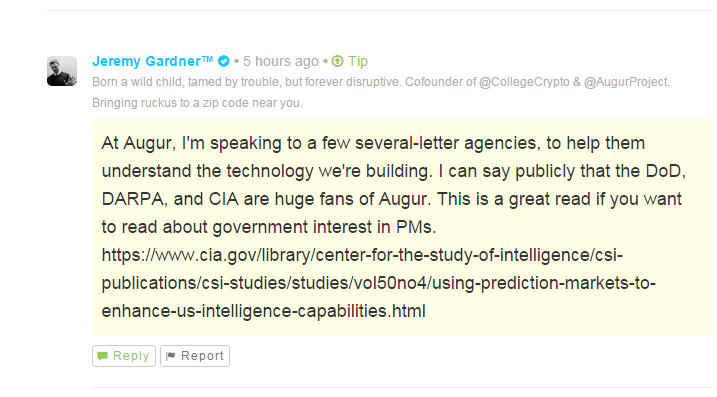

C. Whatever this clueless response from Jeremy Gardner is:

D. The fact that Augur crowdsale required people to publish their real name, despite the fact that the protocol itself has no awareness of a user’s identity.

…not exactly BitTorrent, right?

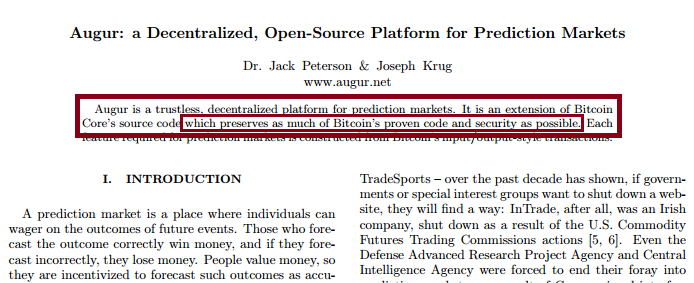

5. Why isn’t Augur a fork of Bitcoin’s cpp code?

Basic principles of software modularity, security, collaboration dictate that this be done. I mean, it…

- Saves a lot of work, especially “hidden work” like debugging, vulnerability fixes, etc.

- Makes the code easier to read for Bitcoin people (ie the Bitcoin devs and hackers who would be essential to the future of this project).

- Prevents people from needing to learn (in steady-state) two completely different codebases if they want to contribute to “blockchain technology”.

- Makes it so that the Bitcoin codebase can be readily compared to the new codebase

- Allows improvements (lightning network, etc) to more-easily cross-pollinate.

Such a no-brainer.

Above: the original Augur whitepaper, written in mid-2014, when Augur was trying to get me to become their advisor.

6. Crowdsale

Augur used a crowdsale. Crowdsales are horribly immoral and produce incentives which guarantee failure.

Just ask Bitcoin Superstar Gavin Andresen, or ask The Ethereum HexHouse Guy.

Ok, but even if they did have any idea what they’re doing, there’s still a huge case to be made against Augur.

Part Two - The Augur Leadership Team Are Frauds

My hat is off to the Augur marketing team…they’ve done a great job.

Good for them.

The other individuals, most prominently Jack Peterson, Vitalik Buterin, Joey Krug, Joesph Costello, and Jeremy Gardner knowingly defrauded the public in several ways.

By “defrauded”, I mean that they knowingly represented themselves in a way that was not accurate.

Moreover, it is pretty clear that the did this for the sole purpose of “getting more money”, because:

7. I publicly challenged Augur (and later Vitalik Buterin) to a debate, on the topic “The Augur Crowdsale is not being conducted honestly.”, and they refused.

It was smart of them to refuse, of course, because (all of them) would have gotten crushed. Still, in another sense, it should tell you everything you need to know, shouldn’t it?

Still, I typed up some of the material here, way before their crowdsale took place, to try to help the public make an informed decision.

Now, the sheer volume of concealed-incompetence is too vast, so I will just focus on two items (8 and 9):

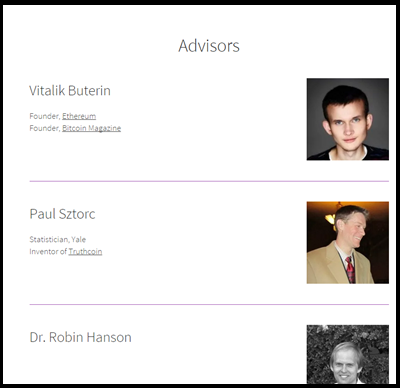

8. Augur’s “Advisors”

Let’s set the record straight on this. Here’s the advisor list in May 2015. I choose May 2015 because I was still associated with Augur at the time, as an “advisor”, and I also knew all of the other advisors at that time.

Maybe things have totally changed since then. Who knows.

Anyway, the May 2015 list contains me! In fact, I was listed 2nd, despite my being largely unknown in Bitcoinland at the time.

Unlike #1, Vitalik Buterin, who was ultra famous.

Vitalik Buterin

Big V is certainly a smart guy and a big Truthcoin fan.

He was such a big fan that he invested some of his own money in Augur. What he lacked in “due diligence”, he made up for in synergy by re-directing Augur into his other project, Ethereum, so as to silence all of those people who wouldn’t stop asking him inconvenient questions (like: “What is Ethereum useful for, exactly?”).

Dr. Hanson

Dr. Hanson is The Man, godfather of modern prediction markets, and runs one of the greatest websites on the internet. I contacted him about Truthcoin in early 2014, knowing that he helps all PM projects, even the ones he doesn’t believe in (his generosity with his knowledge, is surpassed only by his skepticism). He did indeed help Truthcoin, despite being a Truthcoin/Augur skeptic in addition to being a Bitcoin/Blockchain skeptic.

Ron Bernstein

Ron is fourth. He played a large part in the creation of InTrade.com, another candidate for Internet’s Greatest Webpage. Since it failed, he has been trying heroically to resurrect it (as have I). He heard about my project from this tweet in June 2014 and emailed me to talk. Months later, I told him about the different teams working on Truthcoin, including Augur. Augur had lunch with him in NYC once, and asked him if they could use his name on the website. He said ‘of course’.

The Others

Dr. Othman is a researcher who works with the math behind Market Scoring rules. He’s a smart guy, but no advice from him is required: MSRs are just a single formula, and he already published his good forumlas. He is listed there to pad the intellectual/academic stats, and is not a Bitcoin expert.

Elizabeth Stark, I’d never seen in the Augur Slack chat (where I resided for over 8 months) or anywhere in connection to Augur (as with Dr. Hanson and Bernstein). I’ve never heard of her, her website has like 7 sentences…she was probably just some blind entrepreneur promotional reciprocation.

Houman Shadab is some lawyer. He seemed like a nice guy…for all I know, he gives good legal advice.

Joe Costello is the investor who paid Augur’s bills in 2014, in exchange for equity. Obviously he’s hoping for an impressive crowdsale, so that he can be repaid!

These Advisors are not Endorsements

Augur actually has no technical endorsements, only “good approach” Truthcoin-endorsements which they re-purpose.

And yet, Augur constantly is using the adviser list to feign some kind of exclusive relationship with these people, which does not exist.

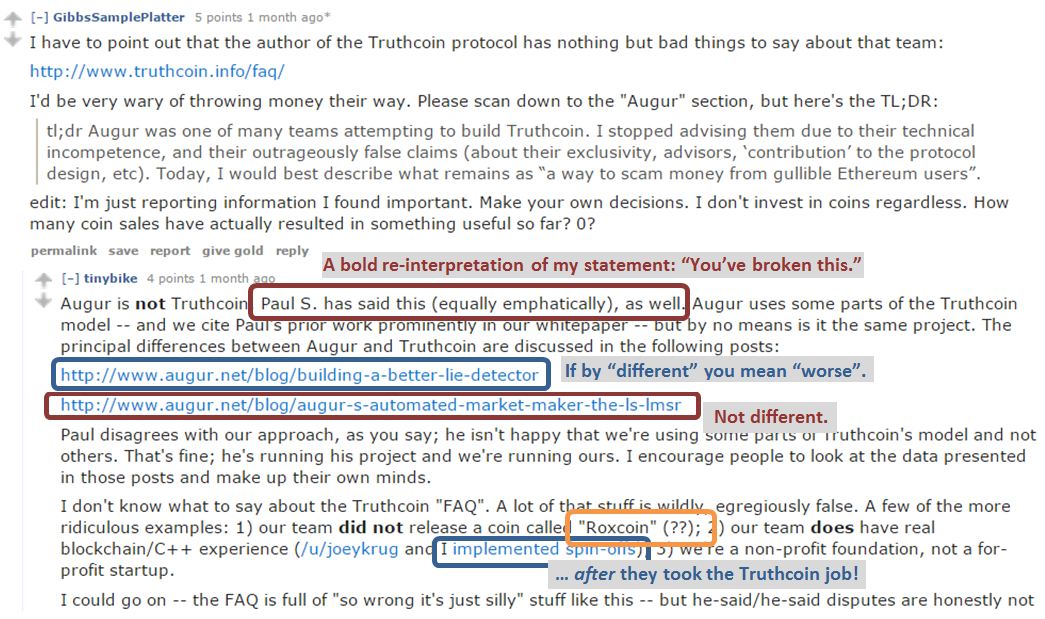

9. Jack Peterson’s Attempt at Rebuttal

Once, Jack (Augur CTO) responded to my entry into the Truthcoin FAQ.

Given that he never accepted the debate offer, this is the closest he ever came to responding to the numerous, extremely-important objections I raised there.

Here’s his response, with my colorful in-line responses:

As you can see, his response doesn’t address any of my main points. ‘Spinoffs’ would count as ‘blockchain experience’, but their software was never tested or used by anybody, so we’ll never know if it was any good.

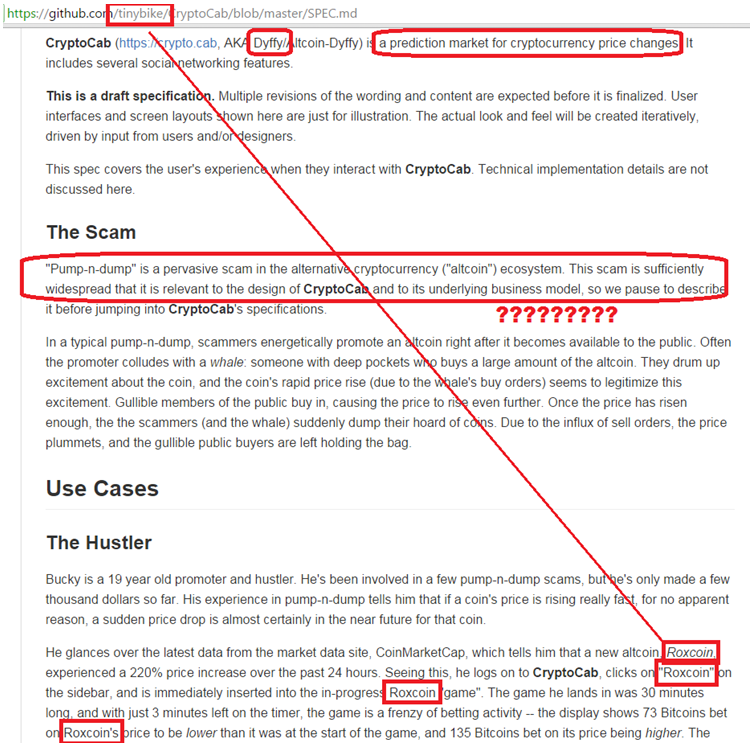

The only thing in the FAQ that Jack actually denies is his involvement with the failed Altcoin called Roxcoin.

But, the only “??” here is that Jack doesn’t remember emailing me about Roxcoin when he was trying to convince me that he had great technical skills.

Apparently he also forgot that Matt, I, and he, discussed it at length over Skype.

What do you mean by “??” exactly?

I mean, one can still dig up all of this confirming information with mere Google searches:

Posted concurrent with this reddit thread promoting Augur’s original venture:

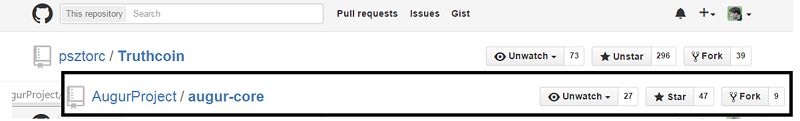

And on and on it goes. For example, this perplexing GitHub documentation:

And…yet…Jack’s response was a “(??)”, because Jack is a liar who thought, I guess, that he could get away with covering this up.

?? Indeed.

Let’s keep going!

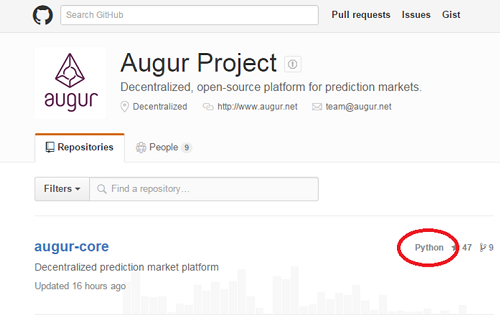

10. Why is Augur using Python?

Python is a great programming language. It is popular to use, easy to read and write, and relatively easy to keep secure.

However, C++ is just faster, and projects need speed if they want to scale (and under-the-radar projects don’t need blockchains).

More importantly, the Bitcoin community has indirectly endorsed C++ for blockchains, because that’s what Bitcoin Core (Ie libconsensus) uses. The Bitcoin Developer community is pretty important; this is no time to start a Language Debate.

So why is Augur written in Python (or, Ethereum’s pseudo-python)?

Zack and Augur

The answer is Zack Hess.

Zack was one of the first to fall in love with Truthcoin (in early 2014), and poured all of his free time into understanding the idea and building it into a python blockchain. Zack built (what is now called) “Flying Fox”, the first implementation of Truthcoin, in python (despite my protest that he should use the C++ of Bitcoin/libconsensus).

Purely motivated by a love of the tech and a vision for the future, Zack (who lived quite modestly, and -I suspect- has something of a stressful life) was volunteering, in his spare time. The Augur team had money, and were generally clueless, so I tried to pair them up in late 2014. Augur hired Zack, and Zack spent 3 months walking them through Truthcoin protocol and his python blockchain.

Unfortunately, the two had a disagreement over employment terms.

The Disagreement

Zack was highly underpaid, in my view. At least two people were making 2.5 times what he was making (according to statements that they made when they were trying to get me to work there), despite the fact that Zack was doing all the heavy lifting.

Of course, that wasn’t the problem Zack had. He was probably happy to get anything at all, and probably didn’t think he was underpaid.

The real disagreement was, in my view, even worse.

Augur vs. Open Source

Believe it or not, Augur forced Zack to sign something so that he would be unable to discuss the software code with non-Augur employees. Zack would even be banned from using the Truthcoin forum, where Zack currently has 280 posts over a period beginning May 2014 (.56 posts per day)!

In fact, this ‘gag order’ would apply, not only while he was working there, but for 2 years afterward! It could only be changed with a shareholder vote (yuck!), and the shareholders could change at any time. Zack couldn’t tolerate this, and felt that it harmed improvement of the software (…which it obviously did).

So Zack felt that he had to leave Augur.

Of course, all of his work stayed behind! Zack doesn’t seem to care, writing their work off as “broken” and often complains that the Augur team “does not understand scalability”.

When Augur “decided” to switch to Ethereum, they did not switch to C++, despite Jack and Joey’s supposedly amazing C++ skills. Instead they waited for Zack to quit, hired a new python developer, and somehow ended up with a Truthcoin consensus system written in python!

In Summary: The Common Misrepresentations

I could do this all day, but here are the three big ones:

-

Jack Peterson, Jeremy Gardner, and Joey Krug misled people into thinking that they were the only ones working on this project, when in reality they were the worst of three “factory workers struggling to assemble a blueprint they didn’t fully understand”.

-

Augur constantly pitches this system as some kind of startup organization, when it is nothing like a startup organization at all. For example, they plan to be “finished” soon, where in reality any cryptosystem would take months, even years of ongoing, attentive work (ideally by tech-loving volunteers) to run smoothly.

-

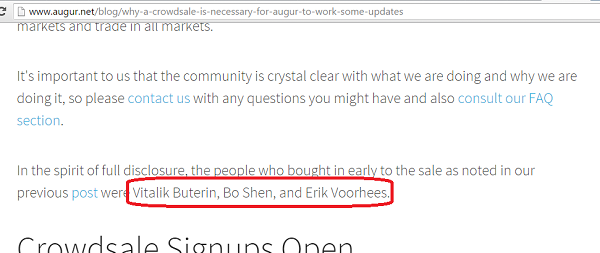

They act like it is a big deal to certain people as advisors, when in reality, these people know almost nothing about what Augur does and are just trying to be supportive in general, or have ulterior motives. Vitalik Buterin, for example, is actually an angel investor in Augur. Crowdsale-victims transferred money from themselves, to Vitalik.

Part Three - On the “millions” raised by the Augur Crowdsale

I understand that someone may read this and wonder, with some justification, “Maybe this guy is just angry that Augur got a lot of money, and he did not, and that is why he is so angry about Augur.”

I’m not worried about my personal financial situation, at all. Moreover, the current best version of Truthcoin, ‘Hivemind’, is financially supported by Roger Ver, who has (as I understand it) much more than $5 million dollars.

Obviously I am not happy to think that I could have contributed, even indirectly, to this scam, by publishing the ideas which Augur used, as an open proposal (under the GPL and later MIT licenses). Certainly, in my view, they were not the best team for the job, and some of them aren’t right for any job.

I certainly made an effort to advise people not to participate, which was time-consuming, and this advice was (at least, partially) ignored.

So, those are problems that I do have with their crowdsale.

Other than that, I guess I don’t really have a big problem with it. There is just something about Bitcoin that causes people to want to give their money to scams.

Here are some other comments:

A. It wasn’t really that much.

Augur claims to have raised about $5 million.

However, crowdsales usually have ‘ringers’: rich guys who buy into the crowdsale to make it look good, and are later repaid (a kind of [fraudulent] off-book liability). That money “doesn’t count”, and the original Augur CEO did take an interest in this tactic, so I am sure that Augur employed it to some extent. It is just something that large IPOs do, even in the “real world” of Wall St.

$5 million isn’t really that much. Mastercoin raised $5 million, and it then rose in value to $132 million. It quickly crashed below-the-Dogecoin, and is presently circling the drain of its final destination of zero. Factom achieved an $11 million valuation, somehow, “21” raised $116 million. Look at pirateat40, or a whole host of other MLM schemes, televangelism, Bernie Madoff, US Social Security Trust Fund, etc. who all did way better than $5 million.

B. Blow your money on whatever you want.

We have to respect consumer sovereignty, don’t we? No one complains when they make money on a risky gamble. After Augur goes to zero, affected users can find “the culprit responsible for their losses” above their bathroom sink.

And nothing makes a good investor happier than watching a bad investor lose money, so I’m forecasting lots of happiness for myself, in the near future.

C. Money tends to go to people who deserve it.

Anyone who had done any due diligence would have known that Augur would be worth zero. Few experts (ie code-literate technical people) were fooled:

So, I’m glad that Augur got to collect some money for their time and trouble. It might as well go to them instead of be wasted on some other scam project. It’s endearing, to know that my idea was so good, that even with an obviously-fraudulent team, a reliance on the so-bad-it’s-nearly-satirical Ethereum, and a categorical rejection by the innovator himself…that -even after all that- it still did pretty well.

Either that, or this community is just way dumber than anyone ever suspected.

Speaking of which:

Et tu, Voorhees?

Costello’s and Buterin’s incentives are entirely predictable, boringly-selfish, and even benign. One can’t sit down at a poker table and then complain about “dishonesty”. They played a great game, and took people’s money, good for them.

Bo Shen is apparently the “CEO” of the Chinese version of i3, which created BitShares. BitShares is a protocol which relied on prediction markets despite the fact that the creator did not understand what prediction markets were or what he was doing. Sound familiar?

However, Erik Voorhees is a bit of surprise. He (apparently) invested with Augur, out of (at the time) at least three better teams. Unlike other investors, I never got an email or message from him.

Did Erik make a mistake? Was he intentionally trying to take money from gullible Ethereum investors? Maybe he’s just too rich to care about what he’s doing. Perhaps he just wanted to help “stimulate” the Bitcoin economy, and couldn’t be bothered to examine the actual effect of his actions (something which, I am sure, he now has in common with the US Congress).

Maybe Augur just lied to him. Who knows?

The End of Open Source?

As I mentioned in the crowdsale essay: all software developers should be warned that working in Bitcoin, an environment of money, will cause them to be thrust, against their will, into a toxic pseudo-corporate “scam or be scammed” political environment. I wouldn’t exactly say that I “recommend” it, so make sure you know what you’re getting yourself into.

Take-aways

- Don’t ask the Augur team how their project works – they don’t know! And you can’t trust them to be honest, anyway.

- Some investors don’t do any due diligence.

- If you’d like to help an open source project, either write code yourself, or sponsor an individual who can code, and have them write code. Do not crowdsale; crowdsales are bad for open source. Downvote all crowdsale-related anything and clearly state your view that it is a scam.